Cash values are an important part of an entire life policy, and show the reserves required to guarantee payment of the guaranteed survivor benefit. Hence, "cash surrender" (and "loan") values emerge from the insurance policy holder's rights to stop the contract and reclaim a share of the reserve fund attributable to his policy. (see #Example of non-forfeiture worths listed below) Although life insurance coverage is often offered with a view toward the "living advantages" (collected cash and dividend worths), this function is a byproduct of the level premium nature of the contract. The original intent was not to "sugar coat" the item; rather it is a necessary part of the design.

Sales strategies frequently attract this self-interest (sometimes called "the greed intention"). It is a reflection of human behavior that individuals are often more willing to talk about cash for their own future than to go over provisions for the family in case of premature death (the "worry intention"). How much is motorcycle insurance. On the other hand, lots of policies bought due to self-centered motives will end up being vital household resources later on in a time of need. The money worths in entire life policies grow at a guaranteed rate (typically 4%) plus a yearly dividend. In certain states the money value in the policies is 100% property secured, implying the money value can not be eliminated in the event of a lawsuit or insolvency.

When ceasing a policy, according to Standard Non-forfeiture Law, an insurance policy holder is entitled to receive his share of the reserves, or money values, in one of 3 methods (1) Cash, (2) Reduced Paid-up Insurance Coverage, or (3) Extended term insurance coverage. All values associated with the policy (death advantages, money surrender worths, premiums) are typically determined at policy problem, for the life of the contract, and usually can not be modified after problem. This suggests that the insurance provider presumes all threat of future performance versus the actuaries' estimates. If future claims are undervalued, the insurer comprises the difference. On the other hand, if the actuaries' price quotes on future death claims are high, the insurance coverage company will retain the distinction.

Because entire life policies frequently cover a time span in excess of 50 years, it can be seen that accurate prices is a powerful challenge. Actuaries must set a rate which will be adequate to keep the company solvent through success or anxiety, while remaining competitive in the market. The business will be confronted with future changes in Life span, unpredicted economic conditions, and changes in the political and regulatory landscape. All they have to guide them is past experience. What does homeowners insurance cover. In a taking part policy (also "par" in the United States, and known as a "with-profits policy" in the Commonwealth), the insurance company shares the excess earnings (divisible surplus) with the insurance policy holder in the type of annual dividends.

9 Simple Techniques For What Is Professional Liability Insurance

In basic, the greater the overcharge by the company, the greater the refund/dividend ratio; however, other aspects will also have a bearing on the size of the dividend. For a shared life insurance coverage business, participation also implies a degree of ownership of the mutuality. Taking part policies are usually (although not solely) provided by Shared life insurance business. Nevertheless, Stock business in some cases provide getting involved policies. Premiums for a getting involved policy will be higher than for a similar non-par policy, with the difference (or, "overcharge") being considered as "paid-in surplus" to offer a margin for error equivalent to stockholder capital. Illustrations of future dividends are never guaranteed.

Sources of surplus consist of conservative prices, death experience more beneficial than expected, excess interest, and cost savings in costs of operation. While the "overcharge" terminology is technically correct for tax functions, actual dividends are frequently a much greater element than the language would indicate. For an amount of time during the 1980s and '90's, it was not unusual for the yearly dividend to surpass the overall premium at the 20th policy year and beyond. Milton Jones, CLU, Ch, FC With non-participating policies, unneeded surplus is distributed as dividends to stockholders. Similar to non-participating, except that the premium might vary year to year.

This allows companies to set competitive rates based on existing financial conditions. A blending of participating and term life insurance coverage, where a part of the dividends is utilized to buy additional term insurance. This can normally yield a greater death benefit, at an expense https://connerhphh.bloggersdelight.dk/2021/09/08/fascination-about-how-much-is-medical-insurance/ to long term cash worth. In some policy years the dividends might be below projections, causing the survivor benefit in those years to decrease. Limited pay policies might be either taking part or non-par, however rather of paying yearly premiums for life, they are only due for a specific number of years, such as 20. The policy may also be established to how to get rid of my timeshare legally be totally paid up at a specific age, such as 65 or 80.

These policies would normally cost more up front, given that the insurance provider needs to develop up enough cash worth within the policy throughout the payment years to fund the policy for the rest of the insured's life. With Getting involved policies, dividends might be applied to shorten the premium paying duration. A kind of limited pay, where the pay duration is a single large payment up front. These policies normally have fees during early policy years need to the insurance policy holder cash it in. This type is fairly brand-new, and is also called either "excess interest" or "present presumption" entire life. The policies are a mixture of traditional entire life and universal life.

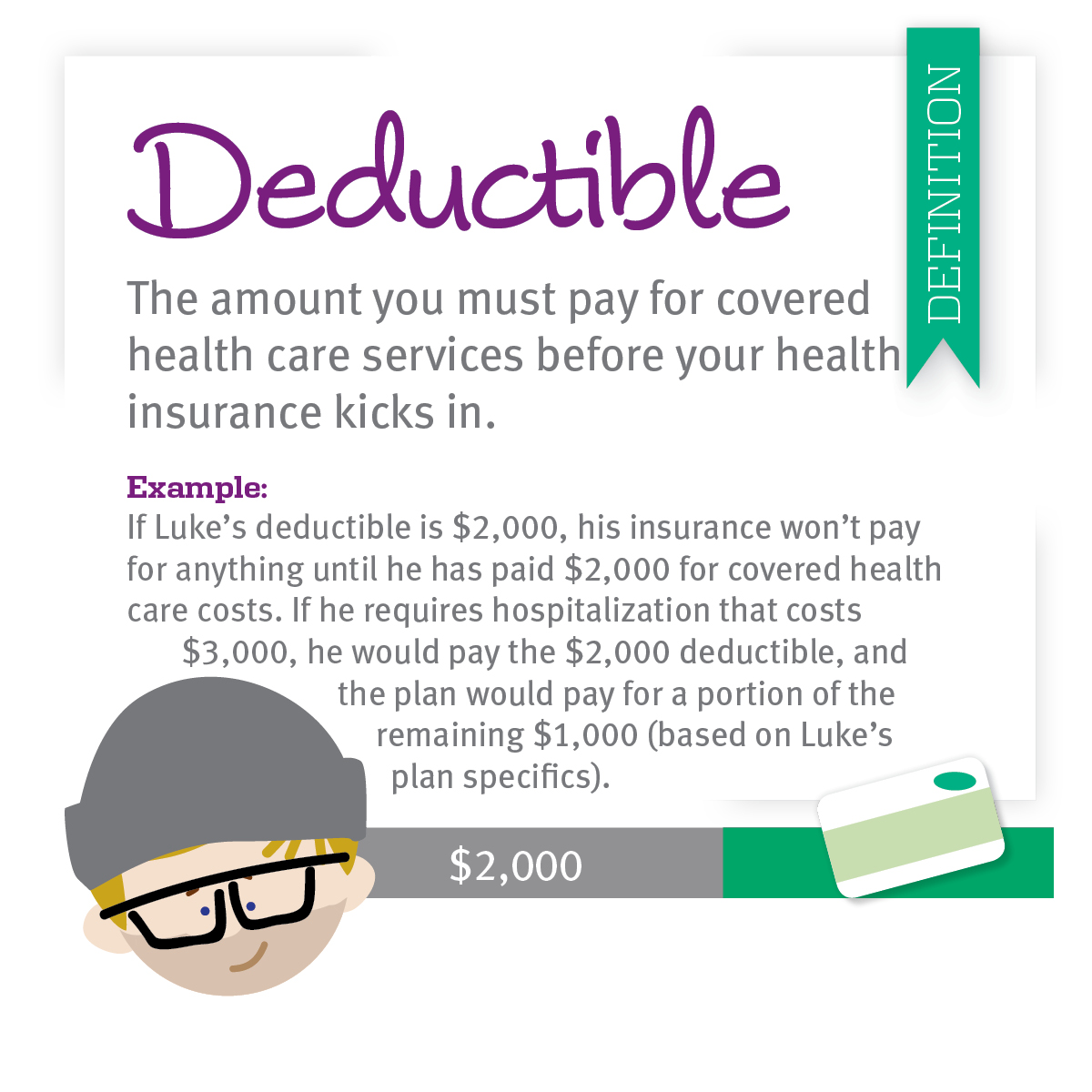

The smart Trick of What Is A Deductible Health Insurance That Nobody is Talking About

Like entire life, survivor benefit stays continuous for life. Like universal life, the premium payment might differ, but not above the maximum premium ensured within the policy. Entire life insurance coverage typically needs that westley todd the owner pay premiums for the life of the policy. There are some plans that let the policy be "paid up", which suggests that no additional payments are ever needed, in as couple of as 5 years, or with even a single large premium. Typically if the payor does not make a large premium payment at the beginning of the life insurance coverage contract, then he is not allowed to start making them later in the agreement life.

In contrast, universal life insurance generally enables more versatility in exceptional payment. The company normally will ensure that the policy's money worths will increase every year no matter the efficiency of the business or its experience with death claims (once again compared to universal life insurance and variable universal life insurance which can increase the expenses and decrease the money values of the policy). The dividends can be taken in among 3 methods. The policy owner can be provided a cheque from the insurance coverage business for the dividends, the dividends can be utilized to lower the premium payment, or the dividends can be reinvested back into the policy to increase the survivor benefit and the money value at a faster rate.